Crypto Fund Tax

Crypto Fund Tax is part of Formidium's tax services group. We offer a full suite of tax services to solve any complexities and challenges in tax calculations, reporting, and filings for digital asset funds. We also offer our all-inclusive tax services to a vast network of managers and funds located globally, covering hedge and private funds investing in blockchain, mining, staking, NFTs, tokenization, and real estate.

Contact usLatest Update

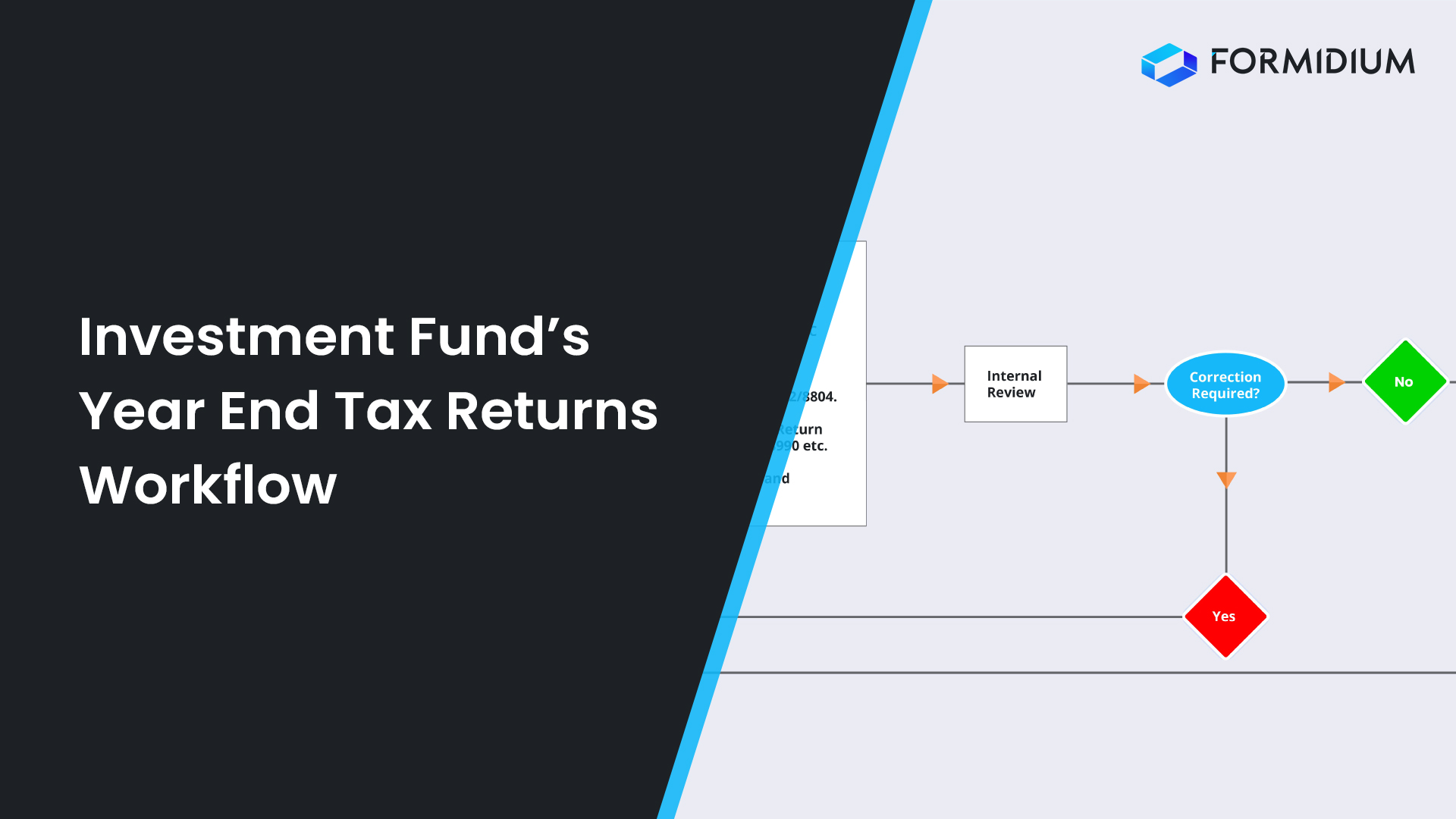

Workflow for Investment Fund

Year-End Tax Returns

This video illustrates the workflow for Investment Fund Year-End Tax Returns, the process follows the execution of a service engagement between our clients and us, and concludes upon the submission of tax returns to the relevant tax authorities, including forms like 1065, 1040, 1120, and 1120-S. Additionally, we ensure the distribution of tax statements to Investors and vendors, such as Schedule K-1, Form 1099, and 1042-S.

150+

DIGITAL ASSET FUNDS

800+

TOTAL FUNDS

50+

TAX PROFESSIONALS

10+

COUNTRIES WE ARE SERVING

Why Crypto Fund Tax?

Crypto Fund Tax is part of Formidium's tax services group. We are located in Downers Grove, IL serving the tax reporting needs of 800+ Funds and have licensed CPAs leading our tax practice. Our experienced and qualified tax service team includes 50+ individuals to handle tax filings and reporting of schedule K-1s for your investors. We use our in-house technology platform to connect with exchanges & wallets to fetch, clean, and sanitize transactional data, calculate capital gains/losses using various methods, reconcile and process a high volume of data, and tax lot accounting.

Using our Proprietary Tax Accounting & Allocation Technology, Seamless Tax, our tax specialists provide you with industry-leading tax support coupled with the highest level of client service, because cutting-edge technology and high-touch client service are at the core of everything we do.

Services We Offer

We provide comprehensive tax services across entity's entire lifecycle, as described below:

- Review of private placement memorandum tax section.

- Preparation of U.S. federal returns (1065, 1120, 1120-S), and state tax returns for all U.S. states, including composite tax returns, handling state filing fees, state tax withholdings, etc.

- Preparation of all supporting and additional tax forms that are filed along with federal and state tax returns. (Form 8949, 4797, 8825, 8990, 8082, 8832-B, etc.)

- Preparation of federal and state schedule K-1 reporting for investors.

- Partner tax allocations using appropriate allocation methods.

- Preparation and compliance with foreign investments. (Form 5471, 8865)

- U.S. tax reporting and compliance for Non-U.S. investors. (Form 1042, 8804, 8805)

- Preparation of international reporting tax forms K-2 and K-3.

- Preparation of other miscellaneous forms like Form 1099s, name change, address change forms, and many more.

- Preparation of responses to IRS and state revenue notices.

- Offering and organizing cost amortization, book-to-tax reconciliations, maintaining tax basis for investor's capital and fund's investment, and handling the assignment of interest from one investor to another.

- Tax lot level capital gain/loss calculations, wash sales calculation.

- Carried interest reporting under IRC 1061.

We provide comprehensive tax services across entity's entire lifecycle, as described below:

- All the items covered for U.S. Funds/Entities.

- Preparation of foreign partnerships, blocking corporations' tax returns, including foreign master-feeder structures.

- Analysis of the entity's structure to determine its applicable U.S. tax filings. (Passive foreign investment company vs. controlled foreign corporation determination)

- Filing applicable tax forms for Non-U.S. funds/entities, including Form 8621, 5472 reporting.

- Preparation of K-1 equivalent forms for Non-U.S. entity/fund's investors, including PFIC/CFC reporting.

We provide specialized tax services tailored to the requirements of crypto funds including analysis and tax adjustments for:

- Contribution-in-kind and distribution-in-kind.

- Wallet-to-wallet transfers.

- Ordinary gain on staking and lending.

- Receiving crypto from an airdrop, rewards, and mining income.

- Crypto interest earnings from Defi lending.

- Crypto earned from liquidity pools and interest-bearing

accounts etc. - Trading in coins, tokens, NFT, SAFE/SAFTs.

Seamless Tax

Seamless Tax is our proprietary tax accounting and allocation technology, a part of our flagship fund accounting software, SeamlessTM. The tax accounting and allocations technology redefines and streamlines the process of calculation & allocation of capital gain/other incomes/expenses, federal/state returns preparation, tax schedules such as K1s, and informational returns such as 1099s and 1042s for Crypto/Digital asset funds. This tax accounting and allocation technology enables tax professionals and practitioners to spend more time on tax data analysis and handling complex tax matters.

Seamless Tax has API connectivity with 160+ exchanges and custodians across digital assets, handles complex allocations & waterfall calculations including In-kind contribution and In-kind distributions of digital assets, process comprehensive DeFi & CeFi transactions and provides tax lot reporting which includes airdrops, mining income and staking rewards.

Seamless Tax generates fund level taxable income/loss numbers and investor level tax numbers after different adjustments as per the tax provisions. It can generate a lot wise capital gain (loss) report with bifurcation of gain (loss) in short/long term and a wash sales report based on trades posted on system.

Seamless Tax ensures that all investor-level tax allocations are calculated efficiently and books vs. tax adjustments are tracked & reconciled. It has good quality controls which ensures efficient and accurate processing of tax returns, K-1s,1099s, and other tax schedules required by US tax returns for investment funds.